Tie Breaker Rule in Tax Treaties

Por um escritor misterioso

Last updated 18 dezembro 2024

Hello Connections, Let’s briefly discuss the Tie Breaker Rule in Tax Treaties. Tie Breaker Rule are used when an individual becomes resident in both contracting states due to their domestic laws/rules, to determine the residential status of such individual for the purpose of taxability of income.

Tax considerations for Canadian snowbirds

Relief Under Section 90/90a/91 of Income Tax Act, DTAA

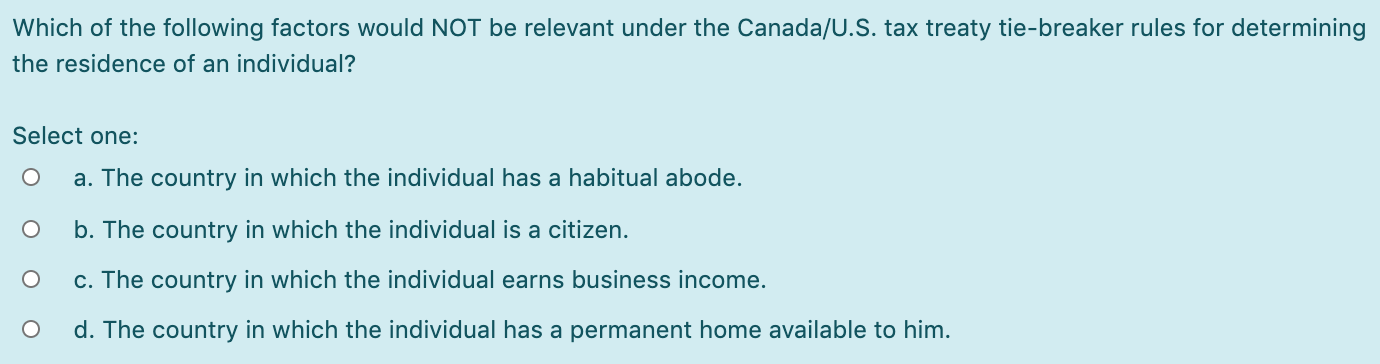

Solved Which of the following factors would NOT be relevant

Tax residency in Canada - overview

THE IMPACT OF THE COMMUNICATIONS REVOLUTION ON THE APPLICATION OF PLACE OF EFFECTIVE MANAGEMENT AS A TIE BREAKER RULE - PDF Free Download

Tie Breaker Rule in Tax Treaties

US-NZ Income Tax Treaty Professional Income Tax Law Advice

U.S. Tax Residency - The CPA Journal

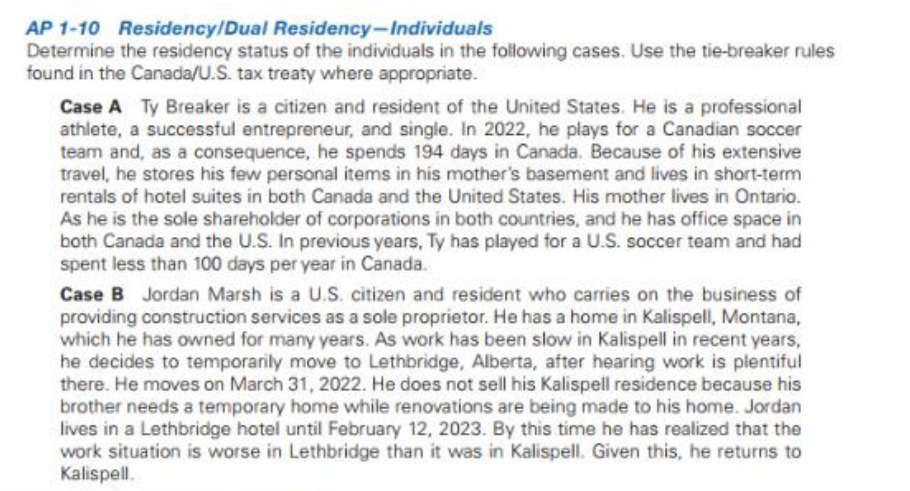

Solved P1-10 Residency/Dual Residency-Individuals etermine

How To Handle Dual Residents: IRS Tiebreakers

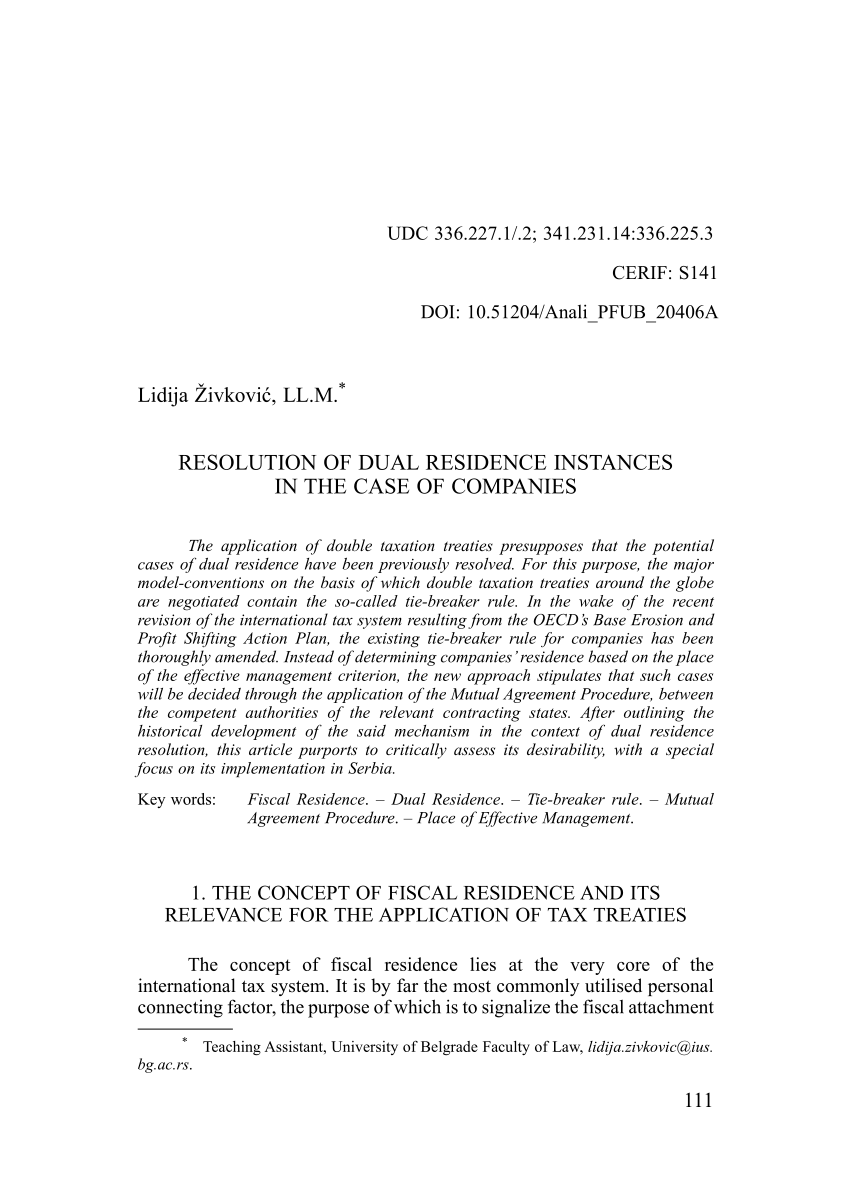

PDF) Resolution of Dual Residence Instances in the Case of Companies

Pre-Immigration Tax Law for Individuals Immigrating to the U.S.

Recomendado para você

-

TIE BREAKER black | Greeting Card18 dezembro 2024

TIE BREAKER black | Greeting Card18 dezembro 2024 -

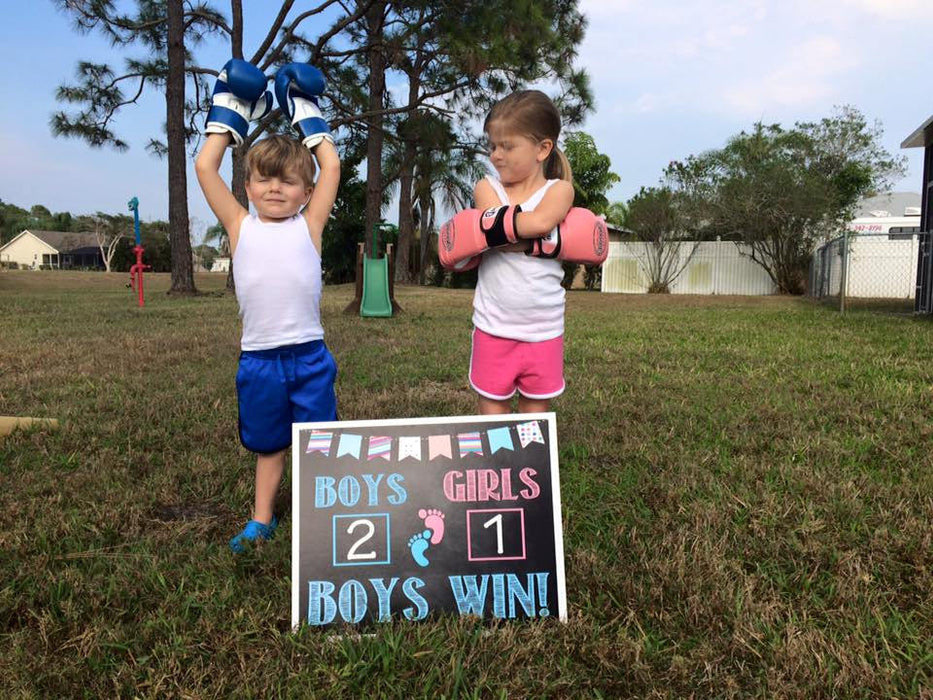

Tie Breaker Coming Soon SVG | Baby Announcement SVG18 dezembro 2024

Tie Breaker Coming Soon SVG | Baby Announcement SVG18 dezembro 2024 -

Handball Rules- Tie breaker18 dezembro 2024

Handball Rules- Tie breaker18 dezembro 2024 -

Use of Tie-Breaker test in determining Residential Status18 dezembro 2024

-

Uh Oh! What's the Tiebreaker? — Meeple Mountain18 dezembro 2024

Uh Oh! What's the Tiebreaker? — Meeple Mountain18 dezembro 2024 -

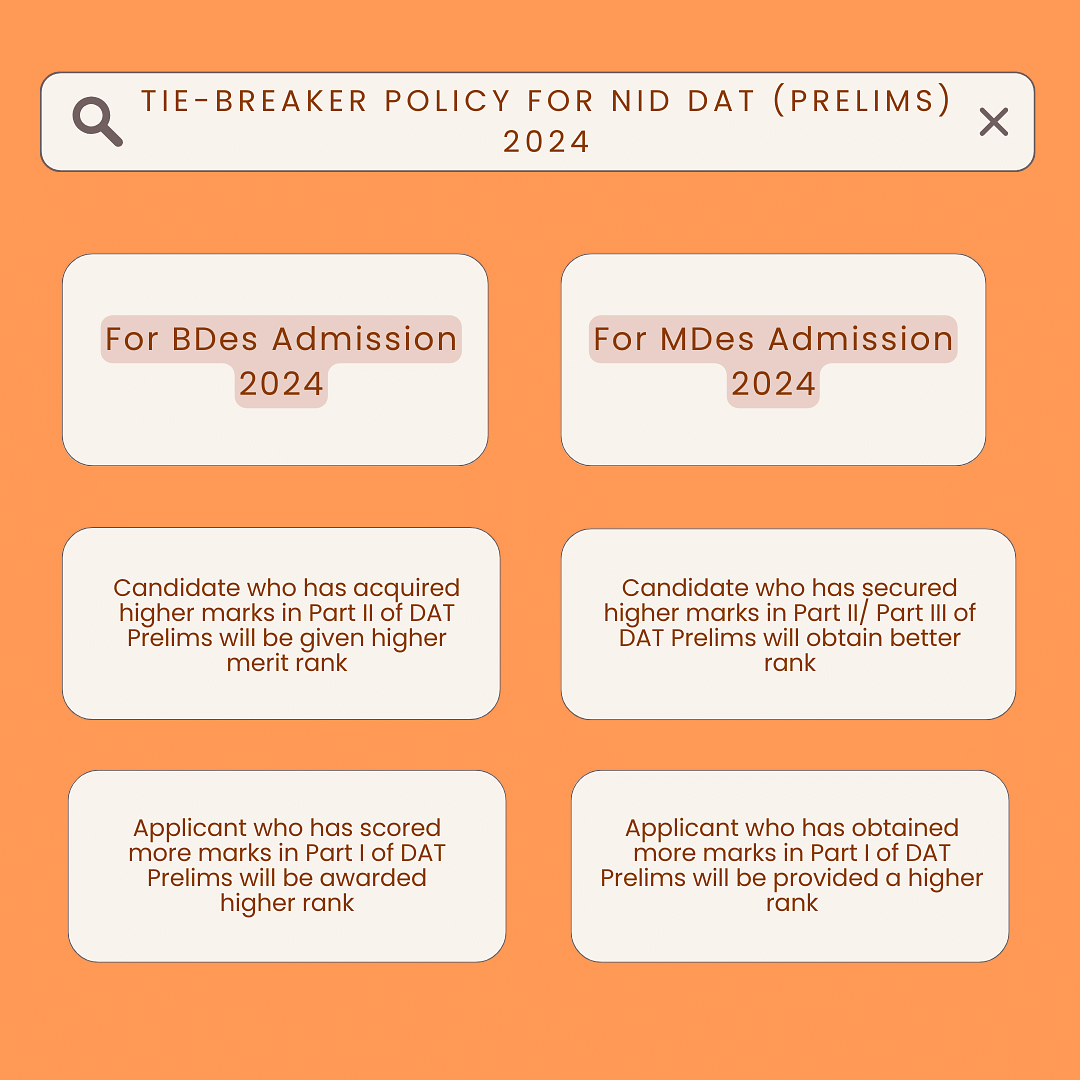

NID 2024 Tie-Breaker Policy18 dezembro 2024

NID 2024 Tie-Breaker Policy18 dezembro 2024 -

Be the Referee: Cross Country Tie-Breaker18 dezembro 2024

Be the Referee: Cross Country Tie-Breaker18 dezembro 2024 -

Men's Los Angeles Lakers Mitchell & Ness Heather Gray Tie-Breaker Pullover Hoodie18 dezembro 2024

Men's Los Angeles Lakers Mitchell & Ness Heather Gray Tie-Breaker Pullover Hoodie18 dezembro 2024 -

Tie Breaker - Apps on Google Play18 dezembro 2024

-

Tie Breaker Pregnancy Announcement - Editable Template18 dezembro 2024

Tie Breaker Pregnancy Announcement - Editable Template18 dezembro 2024

você pode gostar

-

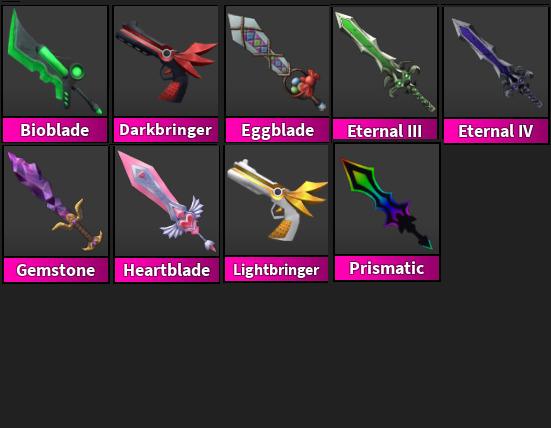

CHEAPEST!! GODLYS MM2 Murder Mystery 2 ROBLOX, Video Gaming18 dezembro 2024

-

If I ask you to name 10 anime series you've watched, what are the VERY first 10 ones that pop into your mind? - Quora18 dezembro 2024

-

10 jogos de sobrevivência para se divertir muito - Canal do Xbox18 dezembro 2024

10 jogos de sobrevivência para se divertir muito - Canal do Xbox18 dezembro 2024 -

Redfall Trailer Introduces Remi and Her Robot Companion18 dezembro 2024

Redfall Trailer Introduces Remi and Her Robot Companion18 dezembro 2024 -

Buy Cooking Simulator - Pizza (PC) - Steam Gift - GLOBAL - Cheap18 dezembro 2024

-

Crunchyroll - Is This a JoJo Reference??? Anime: Oreshura18 dezembro 2024

-

Po jedan VAR penal na obe strane - Spartak i Radnički podelili bodove : Sport : Južne vesti18 dezembro 2024

Po jedan VAR penal na obe strane - Spartak i Radnički podelili bodove : Sport : Južne vesti18 dezembro 2024 -

Top 15 Nintendo Switch downloads - April 2022 : Matthew Paul18 dezembro 2024

-

How to gen contributor img profile · Issue #2881 · badges/shields · GitHub18 dezembro 2024

How to gen contributor img profile · Issue #2881 · badges/shields · GitHub18 dezembro 2024 -

Granblue Fantasy Relink - Which Character Is Right For You? All New Character Gameplay18 dezembro 2024

Granblue Fantasy Relink - Which Character Is Right For You? All New Character Gameplay18 dezembro 2024