How Do the Used and Commercial Clean Vehicle Tax Credits Work?

Por um escritor misterioso

Last updated 04 março 2025

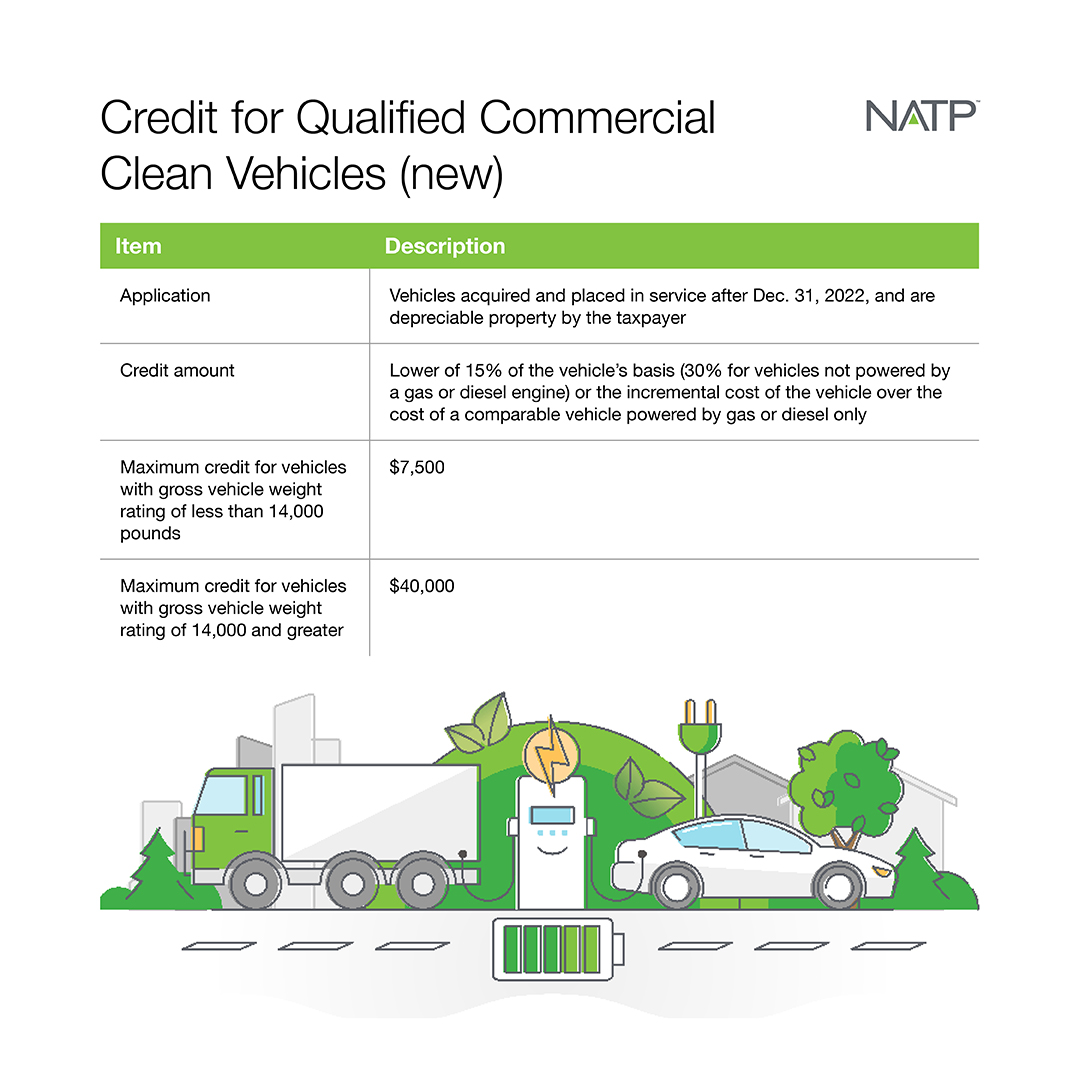

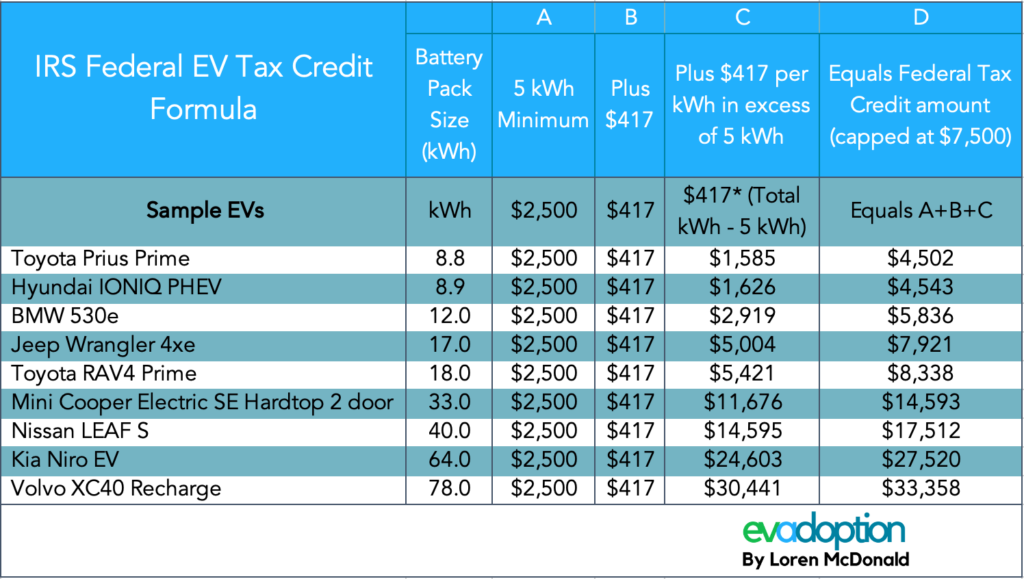

Beginning in 2023, there are two new EV tax credits: the Used Clean Vehicle Credit and the Commercial Clean Vehicle Credit. Here’s what you need to know.

Every electric vehicle that qualifies for US federal tax credits

Electrification Coalition - Inflation Reduction Act Impacts on Electric Vehicles

Upcoming Changes to the EV Tax Credit Explained

Electric Vehicle Tax Credits

Understanding the New Clean Vehicle Credit - TurboTax Tax Tips & Videos

$7,500 electric vehicle tax credit may be hard to get. Here are workarounds

National Association of Tax Professionals Blog

How Do New EV Tax Credits Affect the 'Great EV Takeover?

How Do the Electric Vehicle Tax Credits Work?

Every electric vehicle tax credit rebate available, by state

Proposed Changes to Federal EV Tax Credit – Part 5: Making the Credit Refundable

:max_bytes(150000):strip_icc()/6-ways-to-write-off-your-car-expenses.aspx-Final-97003f07090546d99b4e2cf41c552cbd.jpg)

6 Ways to Write Off Your Car Expenses

Recomendado para você

-

EVS, Inc. (@EVS_Engineering) / X04 março 2025

EVS, Inc. (@EVS_Engineering) / X04 março 2025 -

CBSE Class 3 EVS Work We Do Worksheet04 março 2025

-

Focus: The battery test race to work out what used EVs are really worth04 março 2025

Focus: The battery test race to work out what used EVs are really worth04 março 2025 -

NCERT Solutions for Class 3 EVS Chapter 12 Work We Do04 março 2025

NCERT Solutions for Class 3 EVS Chapter 12 Work We Do04 março 2025 -

Gauleiter 'Whole Mars Blog' can't imagine we want EVs to work, just without scammy Elon Musk : r/RealTesla04 março 2025

Gauleiter 'Whole Mars Blog' can't imagine we want EVs to work, just without scammy Elon Musk : r/RealTesla04 março 2025 -

EVS Tech Job Description04 março 2025

EVS Tech Job Description04 março 2025 -

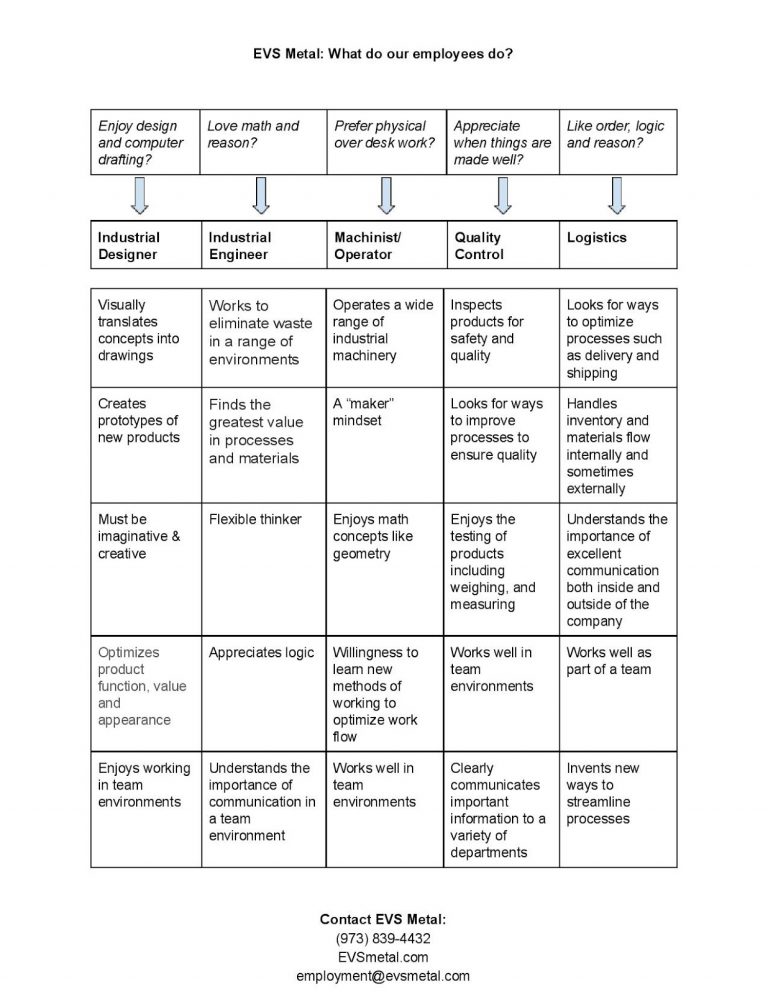

Careers in Metal Fabrication & Manufacturing04 março 2025

Careers in Metal Fabrication & Manufacturing04 março 2025 -

EVS teams are vital to fight against COVID-19 – Jagwire04 março 2025

EVS teams are vital to fight against COVID-19 – Jagwire04 março 2025 -

HF LOOKING AROUND EVS WORK BOOK 3 NCERT04 março 2025

HF LOOKING AROUND EVS WORK BOOK 3 NCERT04 março 2025 -

Evs Supervisor T Shirt - We Do Precision Job Gift Item Tee Poster for Sale by paneczkopat04 março 2025

Evs Supervisor T Shirt - We Do Precision Job Gift Item Tee Poster for Sale by paneczkopat04 março 2025

você pode gostar

-

Assassin's Creed Valhalla revela sus requisitos en PC, recomendando el uso de SSD04 março 2025

Assassin's Creed Valhalla revela sus requisitos en PC, recomendando el uso de SSD04 março 2025 -

blockpost Videos and Highlights - Twitch04 março 2025

blockpost Videos and Highlights - Twitch04 março 2025 -

Boneca Ever After High - No País Das Maravilhas - Apple White Cjf42 - MP Brinquedos04 março 2025

Boneca Ever After High - No País Das Maravilhas - Apple White Cjf42 - MP Brinquedos04 março 2025 -

Technoblade Never Dies Essential T-Shirt for Sale by04 março 2025

Technoblade Never Dies Essential T-Shirt for Sale by04 março 2025 -

I unlocked Fernando last night and got Hasina this morning :) : r/subwaysurfers04 março 2025

I unlocked Fernando last night and got Hasina this morning :) : r/subwaysurfers04 março 2025 -

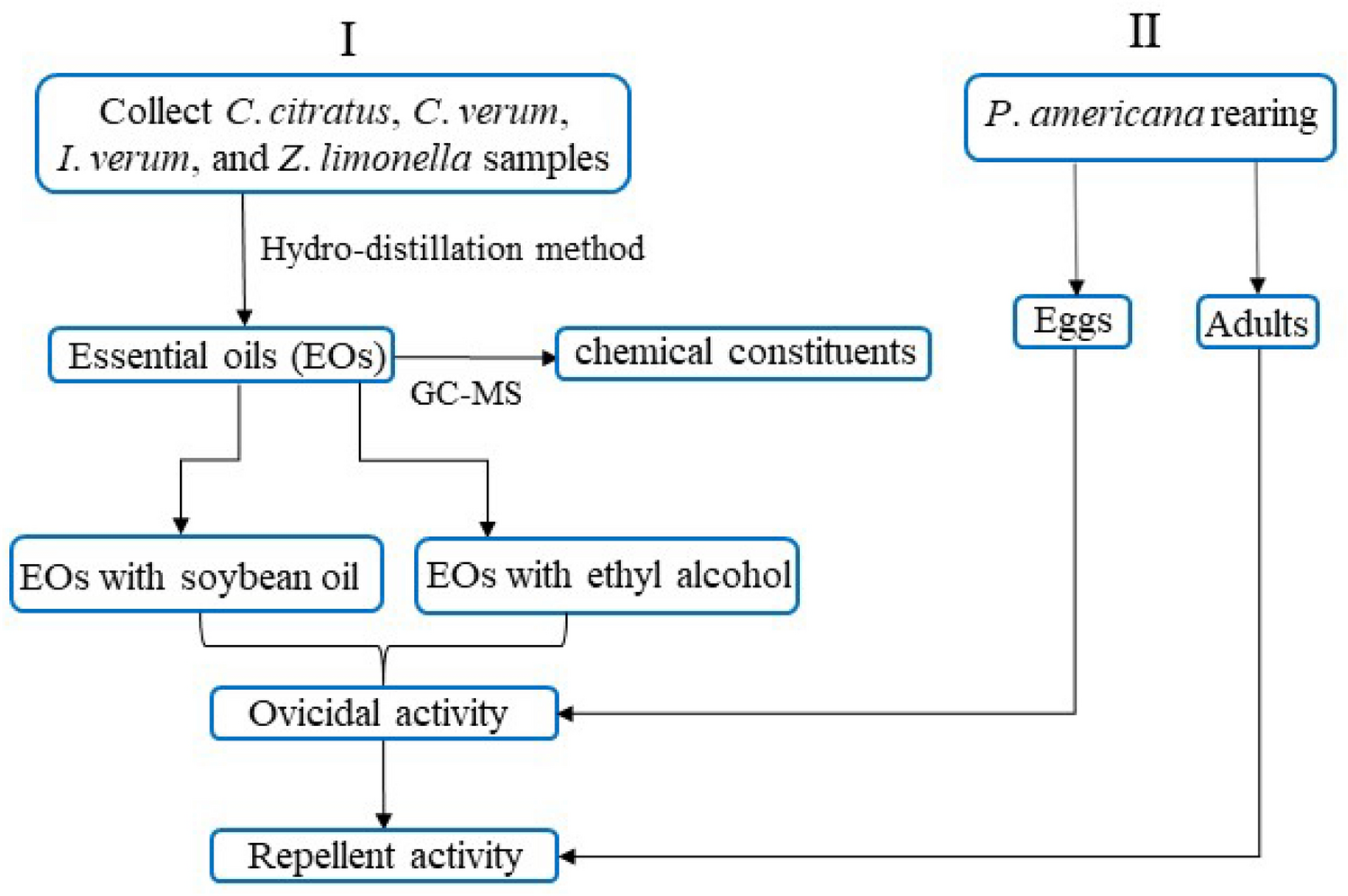

Ovicidal and repellent activities of several plant essential oils against Periplaneta americana L. and enhanced activities from their combined formulation04 março 2025

Ovicidal and repellent activities of several plant essential oils against Periplaneta americana L. and enhanced activities from their combined formulation04 março 2025 -

Tenda de jogos de princesa fabricada em poliéster com saco cor-de04 março 2025

Tenda de jogos de princesa fabricada em poliéster com saco cor-de04 março 2025 -

GitHub - BrookJeynes/slime-rancher-2-interactive-map04 março 2025

-

3D&T Crossover: Guile (Street Fighter) - Personagem04 março 2025

3D&T Crossover: Guile (Street Fighter) - Personagem04 março 2025 -

Scp - 5001, Wiki04 março 2025

Scp - 5001, Wiki04 março 2025